In the emerging era of artificial intelligence and prescriptive analytics, traditional descriptive analytics approaches have lost a bit of luster as the aspirations for these shiny new technologies take center stage. Though emerging techniques provide exciting opportunities to explore data in new ways, descriptive analytics are still valuable to gain a foundational understanding of the current state of the market landscape. When executed with high-quality data, they still deliver critical insights that can inform the entire innovation pipeline, from opportunity identification to go-to-market strategy.

A previous post discussed the consumer-driven disruption and growth occurring in the cosmetic industry. As an industry grows and evolves, the amount of data produced becomes more voluminous and complex, making it hard to keep up with trends and find opportunities. In these increasingly competitive marketplaces, detailed descriptive analytics can be highly valuable to deeply understand the market landscape and strategic alternatives.

To more clearly elucidate the opportunities and risks in the dynamic cosmetics market, the CAS Analytics team completed a detailed analysis of cosmetics patent applications filed over the past five decades, digging below the surface of the most important trends in this evolving industry. The results provide actionable insight and demonstrate how descriptive analytics can guide global expansion, inform supply chain strategy and spark evolutionary innovation.

Global growth drives shift in the cosmetics intellectual property landscape

Averaging 4.2% over the last 8 years (Statista), growth in the cosmetics market has been consistent and shows no signs of stopping. The drivers of this growth are multi-fold, but include an aging population, increased understanding of skin protection and concern about UV, men entering the cosmetics market, and growth of the consumer middle class in emerging markets (Grand View Research, Inkwood Research, Franchise Help).

However, even greater than general market growth has been the accompanying growth of the IP landscape. Cosmetics patent filings have seen nearly exponential growth over the last few decades. This has been driven, in part, by a high volume of patents filed by Chinese assignees, as China has taken the lead from Japan in cosmetics patent volume. Looking beyond China, other countries have stepped in to drive growth as well, with the number of countries with patent assignees nearly doubling over the last 20 years. Japan and France are notable for their relative strength in cosmetics IP relative to other technology areas, suggesting these may be valuable places to monitor innovation trends and look for strategic partners if seeking to enter the Asian or European markets.

Regional differences within natural products boom could impact go-to-market strategy

Consumer preference for natural products is one of the key trends driving innovation in the cosmetics market. Expected growth of 8-10% for the natural and organic beauty care market over the next five years is twice the rate projected for the cosmetics market overall (Persistence Market Research). The patent application landscape has mirrored this trend. Though a wide array of natural products have been used in cosmetics, aloe and rosemary have been the clear leaders in patent applications over the last three decades, with aloe consistently leading for the last decade.

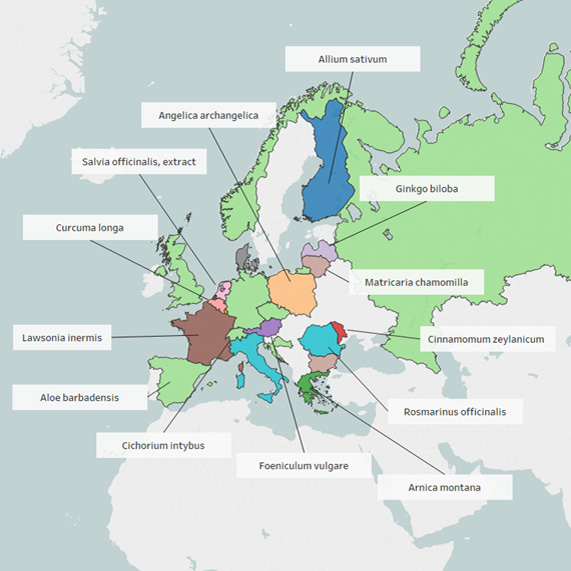

A detailed country-level analysis of natural products cited in patent filings reveals important regional differences. For example, some regions are very consistent in their preferences, while others, such as Europe (pictured below), are more diverse. These differences are critical when considering target markets and go-to-market approaches. Large companies with strong distribution networks can achieve an advantage with scale in the large homogeneous regions, while the more diverse regions may provide excellent opportunities for smaller local and regional players to effectively serve the specialized local markets. Larger organizations may need to consider local acquisitions or third-party partnerships to compete cost effectively in these regions.

New applications and formulations provide pathway to reinvigorate popular cosmetic components

In cosmetics, like many other industries, scalable customization is the next frontier. This is driven by the confluence of consumer expectations for products tailored to their specific needs and characteristics, with industry 4.0 technology enabling customization on a far greater scale and lower cost than previously possible.

To address this evolution, industry leaders must become adept at driving rapid innovation and getting new products to market quickly. Creative IP and business strategies will also be required to protect these new formulations and maintain a competitive advantage. However, this is easier said than done. One solution is to find opportunities to use long-popular components, such as aloe, in new ways and developing new formulations to drive refreshed product offerings with reliable benefits.

Aloe has remained one of the most popular natural products for cosmetic use for decades due to its attractive properties and relatively low cost to process. With so many existing products utilizing aloe, it can be hard for cosmetics companies to find any IP runway to introduce new product formulations containing this attractive ingredient. In fact, our analysis shows that hundreds of other substances have already appeared in published patent applications with aloe. Analysis of CAS roles indexing, which describe the specific uses of a substance in each patent, shows that the primary function of aloe in these formulations is as a skin conditioner. Other top aloe-containing formulations have anti-aging and sunscreen applications.

As novel formulations are generally patentable globally, a possible strategy to innovate in this crowded space is to focus on using aloe in less common applications or in formulations with less common components where there may be more IP whitespace. Descriptive analytics allow you to rapidly overview the various formulation components and intended uses to identify these areas of opportunity. A future blog post and whitepaper will discuss how predictive network analysis can also be used to explore innovation opportunities in cosmetics.

Customized analytics for actionable strategic insight

As demonstrated here, analysis of public data resources provides valuable general insights on a particular market, region or technology area. However, when more specific, actionable conclusions are needed to drive the strategy of your organization, a custom analytics project can provide much deeper insights. With custom analytics, you can get a fuller picture of the situation by combining high-quality external data sources, such as the CAS content collection, with proprietary internal resources, such as customer information, an existing IP portfolio of compounds or formulations, and geographic sales data. Also, custom analytics allow you to pursue answers to specific questions that are most impactful to your organization and the results can remain proprietary, providing a unique strategic perspective to your organization.

Looking for custom analytics to provide deeper insights at your organization? See how CAS Knowledge Services can help.