Gene and cell therapies are now providing patients with treatments for many traditionally incurable diseases. These clinical successes are likely to be just the tip of the iceberg—the full promise of this field is yet to be realized. Pharmaceutical companies are therefore investing heavily in R&D to develop new products, with a surge of gene and cell therapy agents now entering early development. In fact, the FDA is anticipating more than 200 Investigational New Drug applications in this field per year by 2020, with 10-20 new approvals per year by 2025.

Alongside this strong investment in R&D, we're likely to see fast commercial growth of this sector. The global gene and cell therapy market could increase 33% annually over the next 5-10 years, based on a summary published by Allied Market Research.

According to Angela Zhou, Ph.D., Information Scientist and a contributing author of this blog, this rapidly expanding field presents a wealth of commercial opportunities for those looking to invest. However, deciding where best to focus resources in this evolving landscape can be challenging. To help you understand the sector's current market trends, CAS produced a whitepaper on gene and cell therapies in collaboration with the National Science Library, Chinese Academy of Sciences. This valuable resource has been developed to give a detailed picture of the global R&D environment, so opportunities can be identified to gain a competitive edge in this growing market. Here we summarize the key highlights of our whitepaper and describe how the data can be used to inform gene and cell therapy R&D investment decisions.

What are the leading global trends in gene and cell therapy?

Trends in research, product releases and patent applications are useful indicators of global innovation patterns and can help to identify potential collaborators and pinpoint commercial opportunities. Such information can help companies make better-informed decisions around where to invest time and resources.

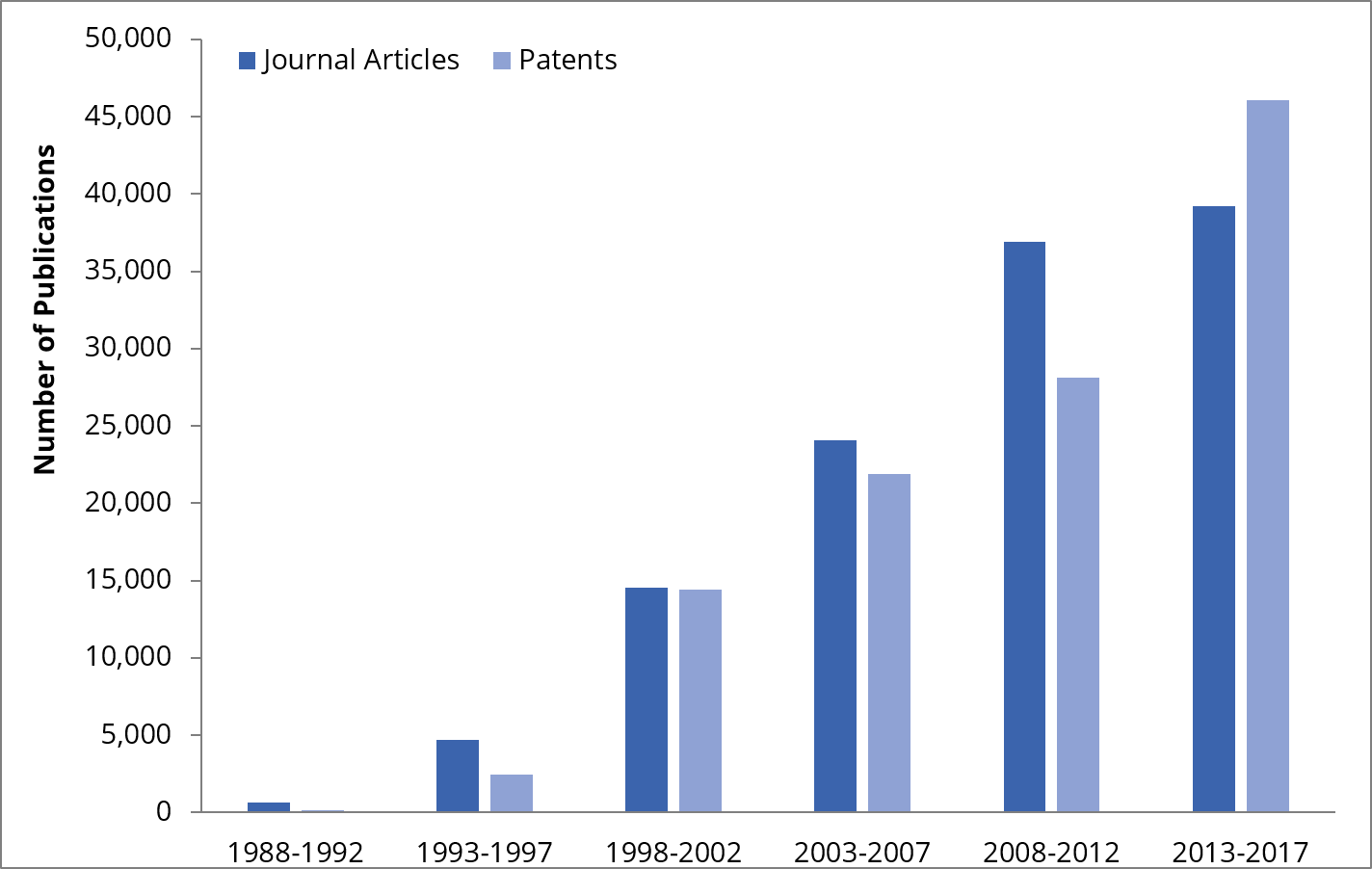

How is the gene and cell therapy market evolving? Looking at the global data, we can see a notable increase in R&D over the last three decades. In fact, by the end of 2017, a total of 120,664 journal articles had been published and 113,229 patent applications submitted concerning gene and cell therapies. Patents in this field have experienced particular growth.

This increase in publications and patents is mirrored by a rise in the number of gene and cell therapy-related substances registered by CAS. Interestingly, while 6,500 substances have been registered in total over the last 30 years, the majority of these have been added in the last decade, and the rate of registrations has rapidly accelerated in recent years. More than 600 new agents were recorded in the first half of 2018, suggesting that this surge of activity is set to continue. This dramatic upswing reflects a turning point in the development and application of these new technologies, which has ushered in substantial commercial opportunities in this field.

To identify the most promising business opportunities in cell and gene therapy, it's useful to examine how research trends vary between countries. This helps to show where innovation is focused and predict where the market is likely to grow, so companies can plan where best to invest to gain a commercial advantage over competition. Taking into account the global picture of gene and cell therapy R&D, the United States is a strong leader, generating overwhelmingly more journal articles and patents than any other country. Other significant contributors include China, Japan, Germany, South Korea and the United Kingdom.

Which market sectors are attracting interest in gene and cell therapy?

Examining the areas of focus in R&D can highlight new opportunities for investment. To help achieve this, our whitepaper examines three sectors that have been identified as areas of significant future promise: stem cell therapies, chimeric antigen receptor (CAR) T-cell therapies and gene editing technologies.

Stem cell therapies

Stem cell therapies are a hot research topic due to their huge clinical potential. As this innovative field develops, there are a growing number of news stories featuring these groundbreaking treatments. For example, Nature recently reported that an HIV patient has been free of the virus for 18 months, following a stem-cell transplant to replace their white blood cells with HIV-resistant versions.

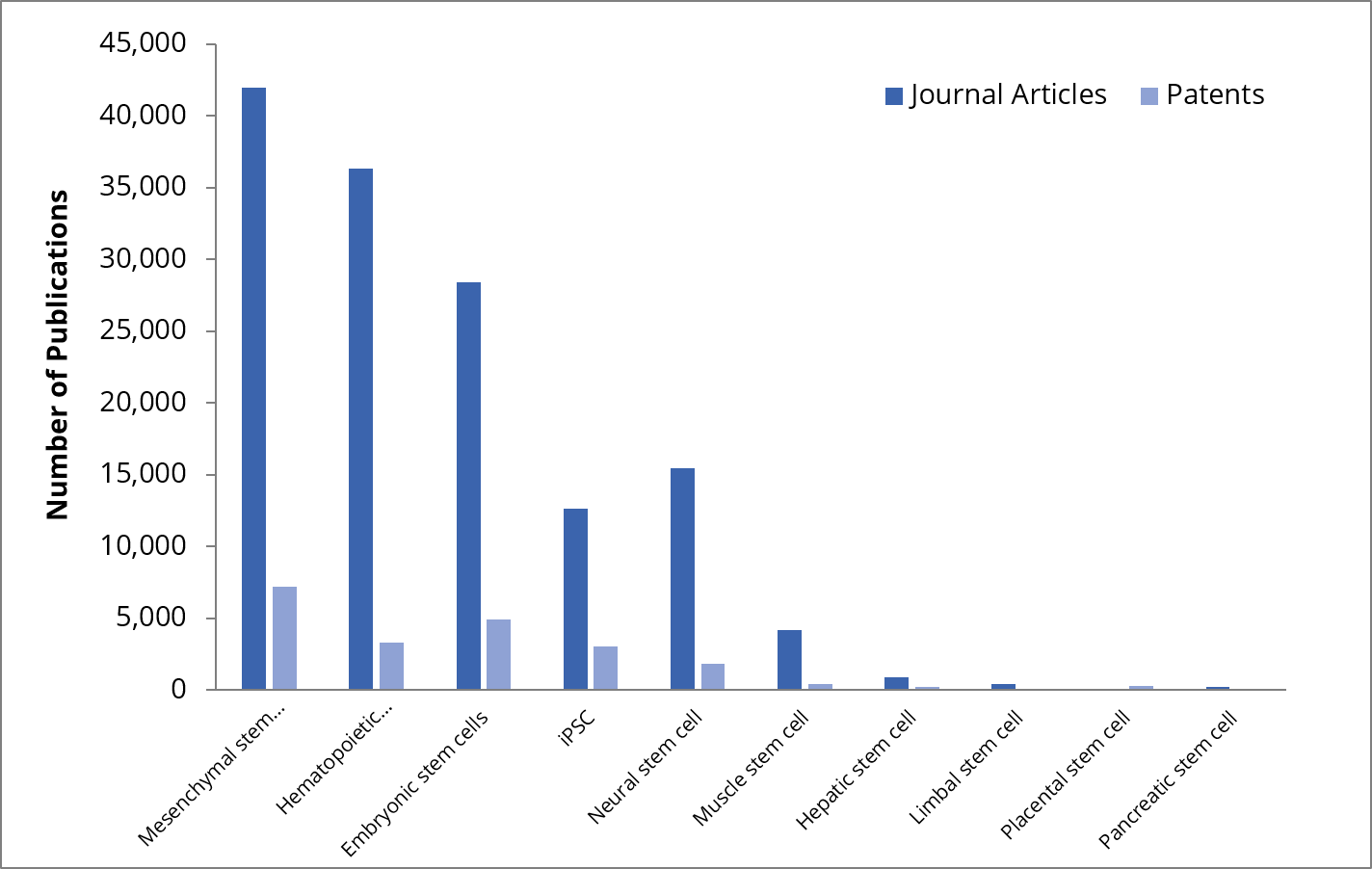

The field of stem cell therapy is growing rapidly, with many different types of cells under investigation. Looking at the balance of research interest between cell types gives an indication of the amount of background information available and the likely level of competition, helping identify the most promising business opportunities. Currently, the three most studied stem cell types are mesenchymal stem cells, hematopoietic stem cells and embryonic stem cells, despite the fact that induced pluripotent stem cells (iPSC) and neural stem cells are also generating a lot of research activities. These highly studied areas might be worth exploring for commercial potential if stem cell therapy is an area of investment interest.

CAR T-cell therapies

Alongside stem cells, CAR T-cell therapies, a combination of gene and cell therapies, constitute a significant area of interest. These novel treatments involve genetically engineering the T-cell receptor to target biomarkers associated with the surface of malignant cells. Therefore, if companies are interested in identifying business opportunities in this sector, it's valuable to know which of these biomarkers attract the most research interest. This can indicate hotspots of innovation and areas where there may be less competitive pressure, helping to determine which avenues of research may provide the most promising investment opportunities.

There are a range of these targetable biomarkers under investigation, of which the most highly studied is CD19. Expressed in malignant B cells, this antigen forms the target for the two CAR T-cell therapy drugs currently approved by the FDA, Yescarta and Kymriah. While CD19 still attracts the most research interest, several more biomarkers have been identified in the last ten years, broadening the scope of CAR T-cell therapies to target different types of cancers. Our analysis indicates that the next most studied biomarkers are CD20, HER2 and CD30, and there are many more potential targets in this growing sector. Since the focus of research activity may indicate potential areas to leverage commercially, it's worth keeping an eye on the more heavily studied targets.

Gene editing technology

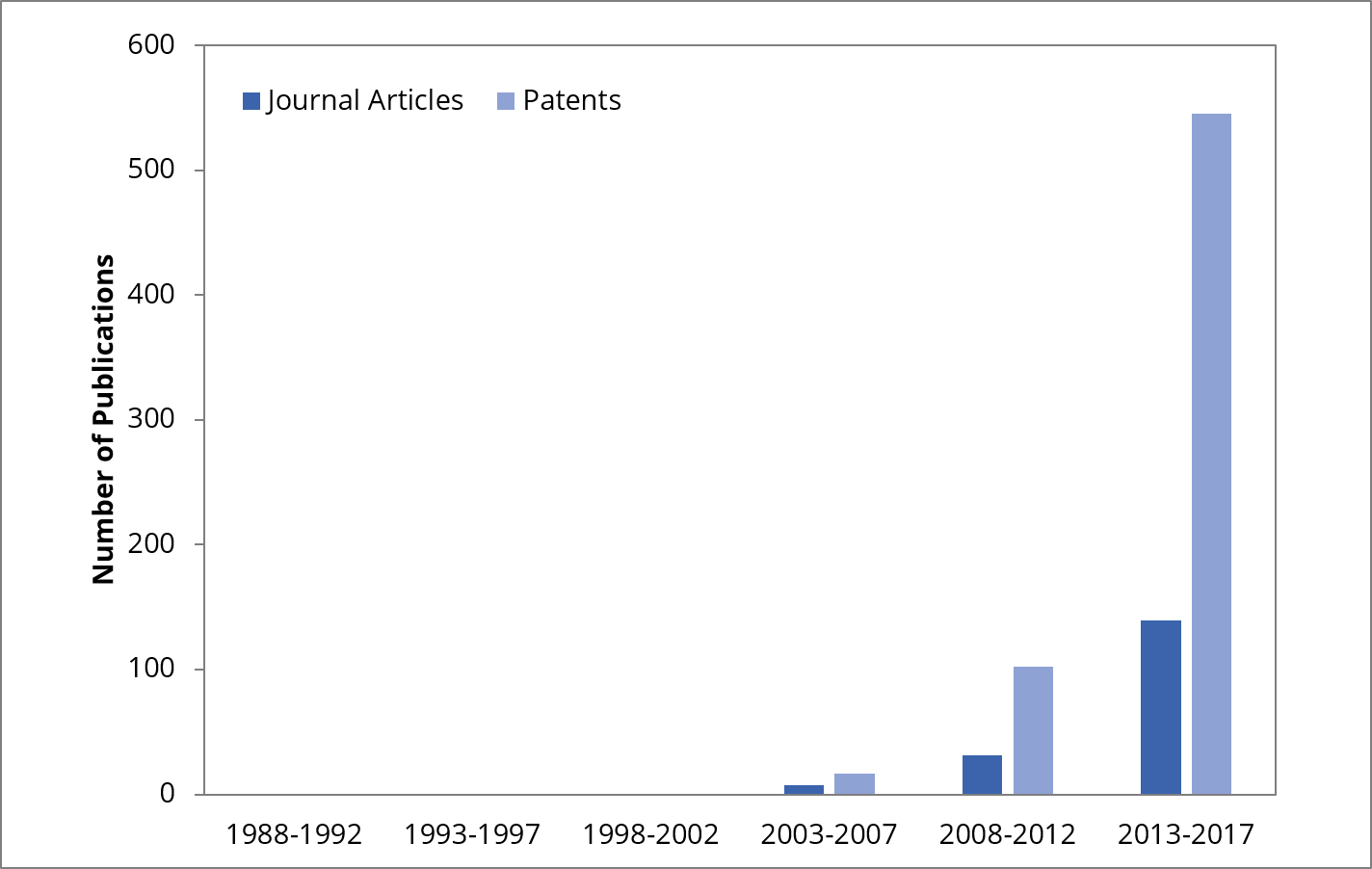

Gene editing technologies, especially the recently developed CRISPR-Cas9 system, have greatly expanded the scope of gene and cell therapies. Indeed, the CRISPR-Cas9 technique has enormous therapeutic potential as it allows efficient and precise insertion, deletion, modification or replacement of a particular gene in the genome. Given the wide range of applications of this technique, gene editing technology has stimulated a wave of interest, with a dramatic rise in the number of patents in recent years. This rapid increase reflects the strong desire for organizations to own intellectual property in this promising area.

This new and exciting field could provide a valuable area to advance a company's business. However, to capitalize on these potential opportunities, it's vital to keep on top of the latest developments and have a clear picture of the main avenues of investigation in R&D. An analysis of substances registered by CAS highlights that the vast majority of clinically relevant gene editing agents are CRISPR-related substances, followed by transcription activator-like effector-based nucleases (TALENs), zinc finger nucleases (ZFNs) and meganucleases.

Leverage the potential of gene and cell therapy

The dramatic market growth in gene and cell therapy reflects the increasing promise of this field. Indeed, these innovative new therapies are set to take the development of biologics to a whole new level, with the potential to treat many diseases that are currently difficult to manage.

To capitalize on the significant commercial opportunities in this area, you'll need a clear picture of the evolving market. Our whitepaper is designed to help you achieve this, by giving you an overview of the landscape and shedding light on potential areas of interest.

Download the report today to take advantage of these insights and contact CAS to learn how our experts can help.