March 3 marked World Wildlife Day, an annual U.N. celebration to recognize the importance of the world’s wild fauna and flora. As conservation awareness has grown over the last decade, so has the consumer preference to use natural products over synthetic chemicals whenever possible. This changing preference is driving rapid growth in the natural products sector and significant market shifts in a number of impacted industries, including food, personal care, home care and lawn and garden.

The growing natural products market

Though the proper definition of words such as “natural” and “organic” have been widely debated across multiple industries, the term “natural products” generally refers to ingredients that come directly from or are made from a renewable resource such as flora, fauna or minerals found in nature with minimal processing (Natural Products Association).

The cosmetics industry has possibly seen the greatest measurable impact to date from growing consumer preference for natural products. The natural and organic beauty care market was estimated to be worth $11 billion globally in 2016 and is expected to grow at 8-10% over the next five years (Persistence Market Research), approximately double the anticipated 4.3% growth in the overall cosmetics industry (Allied Market Research). Companies large and small, from L'Oréal to relative newcomers, such as Tata Harper, are discovering significant growth potential in the burgeoning “land-to-face” movement by launching new products and reformulations of established offerings that primarily include natural products. More often than not, these products are at a premium price point.

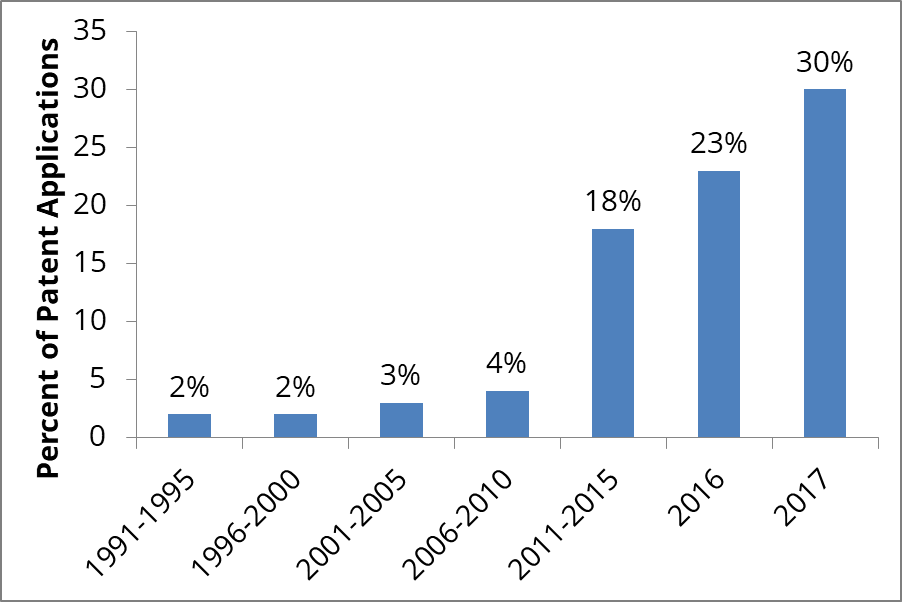

Moisturizers, as one of the fastest growing segments of the cosmetics industry, are a good example of this trend. The occurrence rate of natural products in patent applications filed for moisturizers over the last 25 years shows rapid growth beginning around 2010.

Opportunities created by consumer disruption in an established market

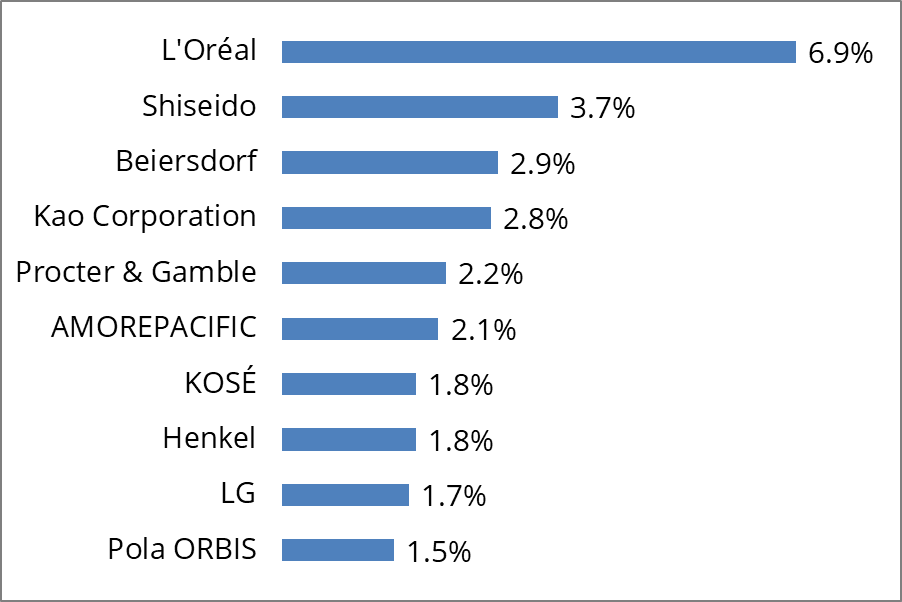

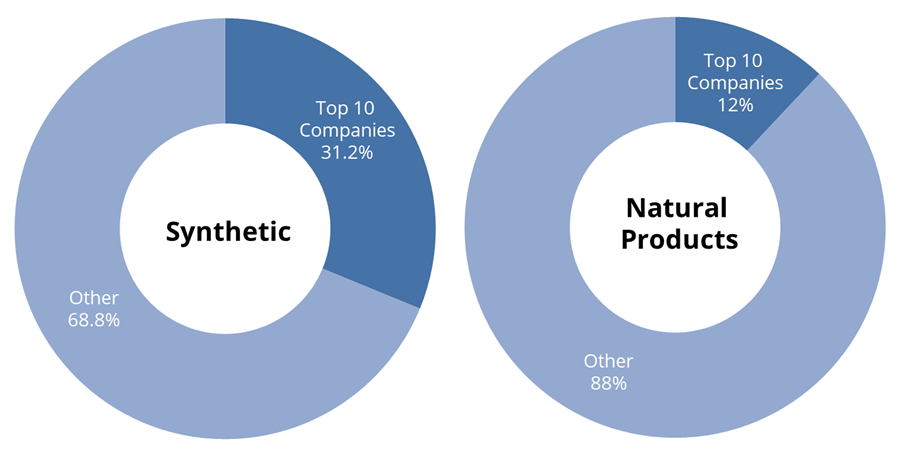

As is often the case when disruptive trends impact an established market, the shift of consumer sentiment toward natural products has provided an opportunity for new entrants to get a foothold in the cosmetics market. Further analysis of patenting trends in the moisturizer space shows that intellectual property in this market segment was historically dominated by large producers, such as L'Oréal, Shiseido, Beiersdorf, Procter & Gamble and Henkel.

However, patent applications emphasizing natural products are coming from a much more diverse pool of global applicants, with emerging regions, such as China, staking strong claims in the space.

The rise of e-commerce has also supported the success of new entrants to this market by lowering barriers to entry and distribution. New innovators that operate near the source of natural components now have direct access to customers where they didn't before. This has been especially relevant to the success of emerging companies in countries like Brazil. The rainforests of Brazil offer extremely high biodiversity, housing ~20% of all known species across the globe and providing an inherent advantage in the natural products segment. Here, newer cosmetics companies that specialize in natural products, such as Natura, are thriving and producers of the raw materials, such as Beraca, are also benefiting from growth in the industry.

Keeping ahead of the competition in a changing market place

Strategy is a critical component of success in dynamic markets undergoing disruption. Competition is often fierce as everyone strives to capture a portion of the growth. Further, regulations and intellectual property laws are often slow to keep up in these dynamic sectors, spawning uncertainty and risk that must be carefully managed.

Uncertainty in the intellectual property arena has been a challenge for companies investing in natural products innovation. Currently, the rules regarding patenting of natural products vary widely between countries. For example, Europe has generally been open to granting a wide range of natural products claims in patents. However, the USPTO has been increasingly reluctant to permit claims of novelty for natural substances following the U.S. Supreme Court’s Myriad decision in 2013. This debate on how natural products should be viewed through an intellectual property lens will likely rage on for years, if not decades, to come. In the meantime, companies are adjusting their strategies to ensure protection of their innovations. One outcome is a greater reliance on innovation in the area of product formulations. Novel formulations are broadly patentable, providing an avenue to claim intellectual property in the space.

With empowered consumers now having easy access to information and tools, such as social media that lowers the barriers to direct consumer marketing and communication, the disruption of industries based on consumer preferences is likely to be the norm for the future. How effectively companies can identify and react to these trends will be a key driver of future success for organizations operating in consumer segments.

What consumer-driven trends are impacting your industry or region?

Need a more efficient way to keep up to date on emerging trends that may impact your strategy? See how CAS can help.